This post is really for my fellow makers and artists who are trying to sell their work in New Zealand. I hope you find it useful but if you have any questions please ask in the comments I will do my best to answer, but please remember I am just a felt-maker, not an accountant or any flavour of financial whizz-kid 🙂

Before moving to NZ in 2021 I had a wonderful little card reader from iZettle, the reader cost me £20 ($40NZ) to buy (no monthly rental fee) and they charged 2.5% of each sale to use it (they even included American Express cards at the same rate). When we moved, I brought my trusty little card reader with us but soon discovered it and almost all similar card readers [Square, Paypal etc] are not supported in NZ.

I started looking into what options are available and was horrified to discover the only offering was those hefty card readers with an internal printer that you see in physical / permanent shops. They are not only hefty in size and weight but also price….. $35NZ per month for rental (plus shipping) and an eye-watering 4-6.5% fee for each sale. That might be acceptable if you have a monthly turnover in the thousands, but like most micro businesses, I don’t. The rental alone would be a substantial percentage of my monthly income. I initially wondered if I could just rent one for 2 months to get through the crazy run up to Christmas but no, they either lock you into a contract for at least 12 months or charge eye-watering amounts in the hundreds of $$ for shorter rental terms.

Curiously all the banks offer these readers at an identical monthly fee, a case of price fixing? I will let you decide.

I have spent the last 18 months continuing to search for a practical and cost-effective alternative and like buses, 2 came along at once….

The Portable Card Reader Option

I was overjoyed to discover Stripe have extended their portable card reader offerings to include NZ, as far as I can tell, they are the first international player to do this. At $137 NZ (including delivery) the reader was substantially more expensive that my iZettle reader but compared to the monthly rental on the chunky EFTPOS machines offered by the banks, I would be saving money by the end of my fourth month of trading.

I ordered the Wisepad 3, the smallest and most affordable reader they offer, it accepts PayWave and chip and pin transactions:

Before you can order a card reader you will need to set up an account with Stripe, this is pretty straight-forward but you will need your NZBN number and a screenshot of your NZBN certificate that includes your address.

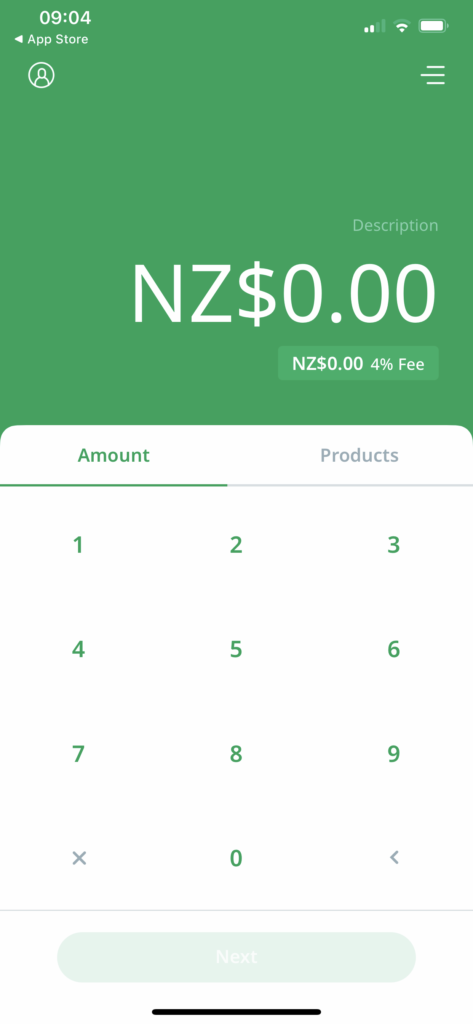

You will probably notice that Stripe is geared towards software developers and their main market is online sales, that freaked me out a little at the start but I soon found an app for the iPhone (I assume there are similar apps available for Android phones but have not looked into that). If you search the App Store for, “payment for stripe” and look for this symbol you will find the app I have been using:

They will charge 1% on top of Stripe’s 3% fee but it is a very easy app to set up and use, and even allows you to automatically add a percentage to each payment to cover the service fees, mine is set up to automatically add 4%:

Taking card payments without a card reader

While trying to find software to work with my new card reader I discovered you don’t actually need a card reader to take card payments!

There are apps available that will allow you to point your phone’s camera at the customer’s card and it processes the information to take the payment. You still need a Stripe account and both Stripe and the app developer will charge you a percentage of each sale but this option avoids the need to purchase a card reader. You just need a smart phone.

PayNow for Stripe was the least expensive I found (0.5% plus Stripe fees) but there may be others with lower fees, please post a comment if you find another app with a better deal. I’m not sure if the Stripe fees will still be 3%, they may be higher if they deem these payments to be “customer not present” but this could still be a viable option if you want to dip your toes in card payment market without the commitment of purchasing a card reader.

I had already received my card reader before I found these apps so didn’t seriously consider using this payment method but I have to wonder how many people would be happy to have a stranger point a phone camera at their credit card and type in the CVV number? I’m not sure I would feel comfortable doing that at a pop-up market.

How is it going? Any downsides?

I have had my reader for nearly a month now and taken around 10 payments with it. The first payment from Stripe to my bank account took about 10 days but the more recent payments have taken 5-6 days.

A few customers have been disappointed by the 4% surcharge (unfortunately Stripe does not differentiate between credit cards and EFTPOS / debit card sales, I am charged 4% on all card payments) but most people understand that to make card payments free I would have to increase all of my prices to cover the costs and that would not be fair to my customers who are happy to pay with cash or bank transfer.

Please post a comment if you have any questions or suggestions the other artists and crafts-people may find helpful.

Disclaimer: Other than a business account, I have no affiliation with Stripe. I do not receive any commission or payments from them or the apps mentioned above. The options described are my personal experience of trying to find an affordable way to take card payments at markets and fairs, Stripe and the apps mentioned above may not be the best option for you or your business, I strongly recommend you carry out your own research before committing to any of them but I hope this blog post will be a useful starting point.

Prices and links correct as of 28 Nov 2022.

Hi

Thank you.

Is this all you found or were there any others?

Hi Michelle, at the time I was looking the Stripe terminal was the only portable card reader that you could buy outright. All the others came with hefty monthly rental fees. I confess I stopped looking once I purchased this terminal, the NZ market may have opened up since then (I hope it has).

This is good reading, I really appreciate finding your blog. I can say I’m stuck between Stipe, Square (have not responding to enquiry yet) and BNZ (holds business account). BNZ looked more expensive but from my husbands point of view their support team is NZ based.

Hi Carrie, that’s good to hear Square might be moving into the NZ market, the card reader space in NZ desperately needs more competition, I find it highly suspicious that all the banks have identical monthly loan fees for their card readers and don’t offer an option to buy the reader outright.

Having used my Stripe reader for over a year now, the only issue I have found is that it can’t cope with the non-chip, old EFTPOS cards and it doesn’t distinguish between credit cards, debit cards, EFTPOS and Paywave – they are all charged at 4% plus 30c per transaction.

Granted it’s not easy to call the Stipe customer care team but I have always found them very quick to respond to emails / message chats.

Hi,

thanks for this useful article.

However, I noticed just by looking at the WisePad 3, that it cannot accept swipe card payments.

Because this would mean that the odd person with an old, traditional EFTPOS card with no chip would not be able to make payments. What do you do to deal with a customer that only has a traditional no chip card, but I assume they are very few

Thanks,

Hi Nathan, that is correct, the wisepad3 cannot take the old style EFTPOS cards that only have a magnetic strip (no chip or CVV number on the back). I have had a couple of people try to use one of these cards but so far they have always had another card with a chip to use instead. On the upside, the wisepad does accept phone / apple watch paywave payments.

I still find it a bit odd that NZ banks continue to issue the non-chip cards as they were banned in Europe at least 10 years ago due to them being very easy to clone. I expect they will be phased out eventually.

Hi Teri, I stumbled across this while researching NZ payment alternatives! I was wondering if you could confirm or clarify whether Stripes terminal/reader and supporting apps have the ability to load stock items with pricing so that manual entry isn’t required? We have a fast moving product that people often by multiples of, so being able to choose & click on products and have the total automatically tabulate is a big help, but I can’t find any confirmation from Stripe on what their units can and cannot do.

Hi Kimberley, this is an interesting question that I’m afraid I don’t have first hand experience of. Looking at the Payment for Stripe app that I use, I can see an option to “add products”, I have tried adding a couple of products to it, and this appears to work, it brings up a list of products, with a +/- next to each item, each time you click the +, the total to be charged increases by the value of the item. This sounds like what you are looking for but does not allow any flexibility to add items not in your stock list, you can’t just add another $5 for a damaged / discounted item for example, but you might able to get around this by having $1, $2…. amounts listed as stock items?

Yes you can add products to the payment for stripe add

As long as you are using a supported phone you do not need to have the external box you simply tap the card on the back of the phone ( however there is no way to enter a ping number ) so only works for lower cost transactions. I using this no problem for things that are less that $100 and never had a customer needing to enter a pin

Thanks Craig, this is really helpful info (especially for Android users with orders valued under $100). Unfortunately it looks like this feature is currently only available in the US for iPhone users but it looks like Stripe are making strides in the right direction. We just need the banks to start issuing chip and pin cards as standard…